Insurance Guarantee Fund UFG - what is it and what are its tasks?

Every motor vehicle owner in Poland has heard of mandatory third-party liability insurance. But do you know what happens when the person at fault in an accident doesn't have valid insurance? Or what happens to drivers who forget to renew their insurance? This is where the Insurance Guarantee Fund (UFG) comes in – an institution that ensures road safety and guarantees protection for road users. UFG not only pays compensation to those injured by uninsured drivers, but also monitors the purchase of third-party liability insurance policies, supports the insurance system in Poland, and offers modern e-services that make life easier for drivers.

In this article, we'll explain in a simple and understandable way what exactly the Insurance Guarantee Fund (UFG) does, what procedures apply to claims for damage caused by uninsured drivers, and how to use the available online tools. This comprehensive compendium will help you better understand the important role the Insurance Guarantee Fund plays in the insurance system and the guarantees it provides you as a road user.

Contents:

- Fundamentals of the functioning of the Insurance Guarantee Fund - definition, mission, and origin of the Polish Guarantee Fund

- UFG as a compensation guarantor - in what situations can you count on the payment of benefits?

- Protecting customers in the face of insurance company bankruptcy - the role of the Insurance Guarantee Fund

- UFG database – a key tool in verifying third party liability insurance policies and controlling the insurance obligation

- Procedure for reporting damage to the Insurance Guarantee Fund - step by step to compensation

- When can the UFG refuse to pay compensation? Exclusions of the Fund's liability

- UFG e-services and online tools - the full potential of the fund's digital platform

- UFG's cooperation with other institutions and the insurance market

- FAQ - Frequently asked questions about the Insurance Guarantee Fund

Fundamentals of the UFG operation – definition, mission, and origin of the Polish Guarantee Fund

What is the Insurance Guarantee Fund (UFG)? Complete definition

The Insurance Guarantee Fund (UFG) is an institution operating in Poland that plays a key role in the motor insurance system. Its primary mission is to protect road users by providing compensation to those injured by drivers who do not have valid third-party liability insurance or who flee the scene of an accident. In practice, this means that the guarantee fund acts as a "safety net" – providing financial compensation even when it is impossible to obtain it directly from the perpetrator. However, the UFG's role is not limited to benefit payments – the institution also monitors the insurance market, oversees the purchase of third-party liability insurance policies, and takes preventive measures.

When and why was the Insurance Guarantee Fund established? A brief history and legal context.

The origins of the Insurance Guarantee Fund (UFG) date back to 1990, when, along with the economic transformation and the increasing number of vehicles on Polish roads, the need arose to create a mechanism to protect victims of road accidents. Previously, victims were often left without financial assistance if the perpetrator did not have valid third-party liability insurance or was unknown. UFG was established under the Compulsory Insurance Act and has since become the foundation of the insurance system in Poland. Currently, it operates under insurance law , adapting its procedures to changing market realities and the needs of road users.

The main goals and tasks of the UFG – the guardian of the stability of the motor insurance market

The UFG's responsibilities are broad and encompass more than just compensation payments. This institution serves as a guardian of the insurance market , monitoring compliance with the mandatory third-party liability insurance policy by drivers and maintaining a register of motor vehicle insurance policies. Furthermore, the UFG enforces penalties for lack of valid third-party liability insurance and conducts road safety education. The fund's key mission is to ensure that no accident victim remains without financial support, even if the perpetrator failed to meet their insurance obligations.

Source: @UFGpl

UFG as a compensation guarantor – in what situations can you count on the payment of benefits?

Compensation for damage from an unknown perpetrator – when does the Insurance Guarantee Fund pay out the benefit?

A road accident in which the perpetrator flees the scene can be a traumatic experience. Fortunately, the Insurance Guarantee Fund (UFG) provides benefits in such situations, covering the costs of medical treatment, rehabilitation, and vehicle repairs. Therefore, the injured party doesn't have to worry that the inability to identify the perpetrator will deprive them of their rightful compensation.

UFG assistance when the perpetrator did not have valid compulsory third party liability insurance

If the person at fault for the accident did not purchase mandatory third-party liability insurance, the injured party is still entitled to compensation. In such a situation, the perpetrator's Third-Party Liability Insurance Fund (UFG) assumes responsibility for paying the benefit. The fund can then pursue the uninsured driver for reimbursement through recourse.

Scope of compensation coverage from the Insurance Guarantee Fund – what does the payment of benefits include?

Many drivers wonder what the UFG (Insurance Guarantee Fund) covers in compensation payments. The fund primarily covers medical expenses, pensions, compensation for injuries, and repair of damaged property. However, it's important to remember that the amount of compensation is determined based on applicable regulations and may have limitations.

Protecting customers in the face of insurance company bankruptcy – the role of the Insurance Guarantee Fund

How does UFG protect policyholders in the event of the insurer's insolvency?

Although insurance company bankruptcy is rare in Poland, the risk still exists – especially in a rapidly changing economy. Fortunately, the insurance system has been protected against the consequences of such situations. When an insurer goes bankrupt , the Insurance Guarantee Fund (UFG ) steps in as a guarantee fund . Its role is to take over the payment of benefits to clients of the insolvent insurance company. This means that policyholders do not have to worry about being left without financial protection in the event of a loss. UFG ensures the continuity of compensation payments, covers medical expenses, and compensates for material losses that would otherwise be covered by the bankrupt insurer.

Claims filing procedure after an insurer is declared insolvent

If an insurance company declares insolvency , clients can submit their claims directly to the UFG. This process is clearly defined and aims to facilitate the rapid recovery of funds owed to victims. To initiate the process, it is necessary to submit an appropriate application to the UFG, along with documentation confirming the loss and the insurance contract. The Fund verifies the application and – if the claim is valid – assumes the obligation to pay the benefit within the limits specified by law. The entire procedure is designed to minimize stress and formalities for clients, who often find themselves in difficult situations following the bankruptcy of their insurer.

UFG database – a key tool in verifying third party liability insurance policies and controlling the insurance obligation

How does the UFG monitor the possession of mandatory third party liability insurance? Control mechanism

The UFG database is a central register of all third-party liability (OC) and comprehensive (AC) insurance policies in Poland. Thanks to this database , the Insurance Guarantee Fund (UFG) can effectively monitor whether each vehicle owner complies with their third-party liability (OC) insurance obligations. Data is continuously transferred to the database by insurance companies – each new policy, its extension, or expiration is entered into the system in real time. If the system detects a break in the continuity of insurance, UFG automatically initiates an inspection procedure and may impose a financial penalty. Thanks to this technology, third-party liability (OC) insurance inspections are performed without the need for a physical roadside inspection – the Fund operates in the background, monitoring the market situation.

UFG online search engine - check your vehicle's third party liability insurance policy step by step

Every driver can check for themselves whether their vehicle has valid third-party liability insurance (OC) using the UFG online search engine . This simple tool, available on the fund's website, allows you to obtain the necessary information in just a few moments. Simply enter the vehicle's registration number or VIN, and the system will return information about the validity of the third-party liability insurance policy and the name of the insurer. The UFG "OC Check" function is particularly useful when purchasing a used car – it allows you to ensure that the seller has current insurance, minimizing the risk of post-transaction issues.

Consequences of not having valid third party liability insurance – penalties and UFG intervention

Not having third-party liability insurance (OC) poses not only a financial risk in the event of an accident, but also a certain penalty from the Insurance Guarantee Fund (UFG). The Fund's system automatically detects gaps in coverage and imposes significant fines on vehicle owners. In 2025, the fine for not having third-party liability insurance for a passenger car could reach up to several thousand zlotys, depending on the length of the coverage gap. Furthermore, UFG fines are levied regardless of whether the vehicle was used – the mere fact of its registration is what counts. Therefore, it's crucial to regularly monitor the status of your policy and utilize tools such as the UFG database and online search engine.

📅 Penalties for lack of third party liability insurance in 2025

The table shows the amount of penalty fees imposed by the Insurance Guarantee Fund depending on the type of vehicle and the length of the break in third party liability insurance.

According to regulations, failure to maintain valid third-party liability insurance is subject to financial penalties determined annually by the Insurance Guarantee Fund (UFG) based on the minimum wage. The fee depends on the type of vehicle and the number of days of delay:

| Time without third party liability insurance | Passenger car | Trucks, tractors and buses | Other vehicles |

|---|---|---|---|

| Up to 3 days | 1,870 PLN | 2,800 PLN | 310 PLN |

| From 4 to 14 days | 4,670 PLN | 7,000 PLN | 780 PLN |

| Over 14 days | 9,330 PLN | 14,000 PLN | 1,560 PLN |

Source: UFG, Regulation of the Council of Ministers of 12 September 2024 regarding the minimum wage and the minimum hourly rate in 2025.

The procedure for reporting a loss to the Insurance Guarantee Fund – step by step to compensation

Who can report a loss to the Insurance Guarantee Fund and how? Requirements and forms

If you were injured in a road accident caused by a driver without valid third-party liability insurance (OC) or the perpetrator fled the scene, you can report the damage to the Insurance Guarantee Fund (UFG) . Importantly, the report does not go directly to the Insurance Guarantee Fund (UFG) – the application is submitted through any insurer that offers mandatory third-party liability insurance. The insurer conducts the claims settlement process and then forwards the case to UFG.

To begin the process, simply complete the UFG form, available at the insurer's office or on its website. If you have any questions, you can also contact the UFG hotline or the UFG contact section on the fund's website, where detailed instructions can be found.

Necessary documents and information to submit a claim to the Insurance Guarantee Fund

When preparing to file a claim, it's worth gathering all the documents required by the Insurance Guarantee Fund. These include:

- police note or road accident statement

- a document confirming vehicle ownership (e.g. registration certificate)

- medical certificates and bills (in case of personal injury)

- repair estimate or invoice (in the case of property damage)

Thanks to complete documents, the damage reporting procedure is faster and more efficient.

Deadlines and stages of application processing by the UFG - what happens after submission?

After submitting the application, the insurer is required to conduct the claims settlement process on behalf of the Fund. The case is then forwarded to the UFG, which makes the decision on whether to pay the benefit. The entire process should be completed within 30 days of collecting all the necessary documents ; however, in more complex cases, this period may be extended to 90 days.

The consideration of the application by the UFG includes:

- Verification of entitlement to benefits

- Calculation of compensation amount

- Payment of funds to the injured party or refusal with justification

Thanks to the transparent procedure and clearly defined deadlines of the Insurance Guarantee Fund, injured parties can count on efficient receipt of the benefits they are entitled to.

When can the UFG refuse to pay compensation? Exclusions of the Fund's liability

Typical reasons for refusal to pay benefits by the Insurance Guarantee Fund - the most common situations

Although the Insurance Guarantee Fund (UFG) is an institution tasked with supporting injured parties, it will not pay compensation in every situation. There are several circumstances in which the Fund may refuse to pay. When will the UFG not pay ? The most common reasons are:

- Failure to document the damage or provide the required evidence

- Filing a claim after the statutory limitation periods have expired

- An accident caused intentionally by the injured party or through gross negligence

- Damage caused to a vehicle driven without the required authorization (e.g. without a driving license)

- Attempts to obtain compensation or provide false information in the application

However, a refusal by the UFG does not always mean that the case is definitely closed – there are appeal procedures that are worth using.

What should you do if the Insurance Guarantee Fund (UFG) denies your claim? Appeal options

If the Fund determines that there are no grounds for payment, the injured party receives a written justification for the decision. In such a situation, an appeal may be filed against the UFG's decision . The procedure includes:

- Submitting an appeal directly to the Fund together with additional documents or explanations.

- If your appeal is rejected, you may be able to take your case to court – in this case, you may want to consider consulting a lawyer to increase your chances of a positive outcome.

Thanks to clearly defined appeal procedures, every injured party has the right to apply for a reconsideration of the case if they believe that the Fund's decision was unfair.

UFG e-services and online tools - the full potential of the fund's digital platform

What does the UFG website offer? A guide to tabs and functionalities.

The Insurance Guarantee Fund's digital platform is a practical tool that significantly simplifies the lives of drivers and road accident victims. The UFG website offers access to numerous online services – from verifying the validity of your third-party liability insurance policy, through reporting damages, to monitoring the status of pending cases. In the UFG e-services tab, users can:

- check if their vehicle has current third party liability insurance

- download the history of vehicle damages

- follow the course of liquidation proceedings

Thanks to its clear structure and intuitive interface , UFG online allows you to quickly access the information you need and complete most formalities without leaving home.

Tools for checking vehicle insurance history and claims through the Insurance Guarantee Fund

One of the most frequently used features of the platform is the ability to view a vehicle's third-party liability insurance ( OC) history . This solution allows you to check whether the policy has been paid on time and whether the vehicle has been involved in any previous road accidents that resulted in claims. The UFG history tool is particularly useful for those buying a used car – all you need is the registration number or VIN to obtain key data. Additionally, the UFG check function allows you to quickly verify whether a given vehicle is covered by insurance.

FAQ section and legal assistance on the UFG website - where to look for support?

For users who have questions or need support using e-services, the Fund has prepared an extensive FAQ section and step-by-step guides. If you encounter any difficulties, please use the UFG contact tab, which includes hotline numbers and application forms. The UFG hotline is a quick way to get help with issues such as reporting a claim, verifying data in the database, or clarifying doubts related to penalties for not having third-party liability insurance. For more complex issues, the UFG help section is also available, where you will find information about procedures and legal support.

UFG's cooperation with other institutions and the insurance market

The role of the Insurance Guarantee Fund in the "Green Card" system and border insurance

The Insurance Guarantee Fund operates not only in the domestic market; its responsibilities also extend internationally. In cooperation with the Polish Motor Insurers' Bureau (PBUK), it participates in the UFG Green Card system, which provides insurance coverage when traveling abroad. This means drivers traveling from Poland can be assured that their mandatory third-party liability insurance will be honored abroad.

The Fund also assists in settlements related to foreign insurance , particularly when damage was caused by foreigners in Poland or by Polish drivers abroad. This cooperation allows for the quick and efficient resolution of cross-border disputes and ensures that injured parties have access to the benefits they are entitled to.

UFG in the road safety system – cooperation with the police and other authorities

At the national level, the UFG plays a crucial role in road safety . The Fund works closely with the Police, the Road Transport Inspectorate, and public administration bodies to ensure compliance with the third-party liability insurance requirement. Access to the UFG database allows authorities to quickly verify whether a driver has current insurance, allowing for more effective enforcement of the law.

This cooperation also has a preventative nature – joint information campaigns and educational activities help build drivers' awareness of the importance of motor insurance. Thanks to this, the UFG, the police, and other institutions work together to create a system that not only ensures the enforcement of obligations but also improves safety on Polish roads.

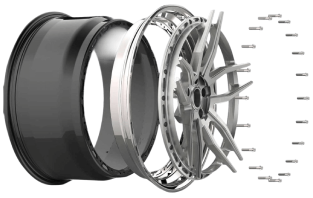

Modern design

Modern design Perfect fit

Perfect fit High durability

High durability Free shipping within 24 hours

Free shipping within 24 hours

Individual project

Individual project Dedicated caregiver

Dedicated caregiver